One of my former portfolio companies was back in the news this week, albeit for less than stellar reasons. After three years of ownership and a lot of drama, Masimo exited the consumer audio business it bought in 2022, Sound United. Masimo is a medtech company that is best known for pioneering the pulse oximeter, which basically measures the amount of hemoglobin and oxygen in the blood using LEDs. What that had to do with home theater and consumer audio was the over $1 billion dollar question back in 2022, and the answer of “not much” came back this week.

For those who don’t know, Sound United is a collection of high-end audio brands. Charlesbank put the business together over a decade, starting with Polk, an approachable American hi-fi brand, and Definitive, a higher-end niche brand. Both of those brands were part of a conglomerate that was originally founded by eventual Republican Congressman Darrell Issa, a guy who allegedly knew enough about stealing cars that he eventually realized the more profitable thing to do was to start a car alarm company. Over time, the car and audio businesses were split apart, and Sound United added Japanese AV-receiver brand Denon, legacy high-end receiver brand Marantz, and luxury British speaker brand Bowers & Wilkins to the portfolio over time. My last business trip before COVID was to the Bowers & Wilkins factory in southern England at the end of February 2020. BBC did a much better job of covering what was happening in China that I returned home sufficiently freaked out, but also unprepared for how the world would change over the next 30 days. We ended up being the only non-UK party that could visit the factory given the border closures, and while I lost a lot of sleep trying to do a distressed, cross-border acquisition of a consumer discretionary business during a global pandemic, the deal closed in Q4 2020 and it ended up being the right move for all.

Anyway – back to Masimo. Going back a decade, Masimo had been attempting to enter the consumer market via a smartwatch. When Masimo came up as a potential buyer of Sound United, I definitely had to Google them, and I quickly fell into a rabbit hole, mostly related to mercurial founder Joe Kiani, the Iranian immigrant who had the balls to sue Apple over alleged patent infringement. As our deal team thought more about what a medical device company might want with some high-end consumer audio brands, we landed on a few potential logical reasons:

- Medtech companies aren’t exactly known for their ability to market to consumers, nor do they have relationships with electronics retailers or e-commerce capabilities. Best Buy and Amazon were important US partners for Sound United, and they had similar relationships with retail partners in Europe and APAC. Developing a smartwatch was one thing Masimo could do internally, but figuring out distribution required new ways of thinking that would take Masimo a lot of time unless they made an acquisition.

- The deregulation of hearing aids was on the horizon in early 2022. Chuck Grassley (R-IA) and Elizabeth Warren (D-MA) collaborated to get the FDA to move this initiative forward, ostensibly to help get around the oligopoly of hearing aid manufacturers and make the devices cheaper for consumers. With hearing aids becoming a consumer product available over-the-counter, combining technical audio knowledge, medical device development chops, and consumer marketing felt like a no-brainer.

- To better compete with Sonos, Sound United had launched a few different multi-room WiFi enabled speakers, powered by the Company’s HEOS software. As patient monitoring (and other forms of healthcare) moved from the hospital into the home, having millions of WiFi-enabled devices in people’s homes created a proprietary ecosystem. The exact shape of this was a bit of a mystery, and it probably wasn’t enough to justify a billion dollar acquisition, but it was something.

- Good old fashioned multiple arbitrage. Masimo paid roughly 8x EBITDA for Sound United, and before the acquisition, traded for a multiple that maybe looked normal to medtech people, but to me looked unjustifiably high in the 40x EBITDA range. So if nothing changed about how the market viewed Masimo, and they could capture that 32x spread on $125m EBITDA, that’s $4 billion of incremental market cap.

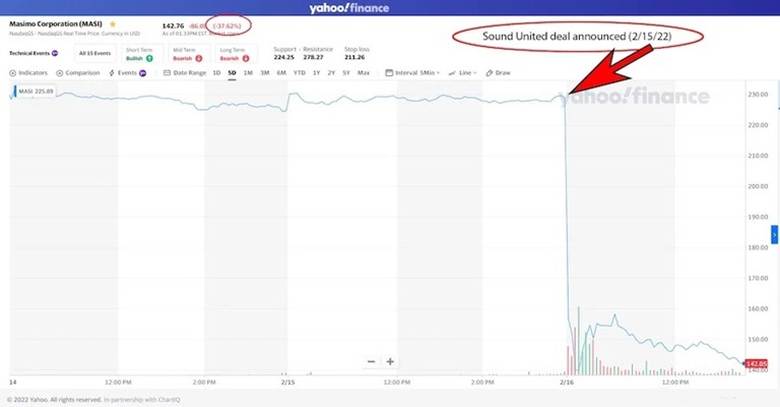

Instead – when the deal was announced, the opposite happened. After announcing they were paying a bit north of $1 billion cash for Sound United, the Masimo stock price dropped by nearly 40%, which meant roughly $5 billion in market cap was erased overnight. This response either defied the logic of corporate finance, or was really prescient, given the next couple years would be very messy for Masimo, as the acquisition led to a distracting, public fight between Joe Kiani and an activist investor, Quentin Koffey. After a couple years, Koffey eventually got the victory, with Kiani out of the company and Sound United sold off. But Masimo’s stock price is effectively flat to where it was the day after the Sound United sale was announced, and the sale price for Sound United to Samsung was only about a third of what they paid, three years later. So – it very much remains to be seen whether Koffey’s theory around a focused, medtech oriented Masimo drives the stock price back up, and whether Koffey’s victory is a hollow one or an economic one.

I remember trying to explain the transaction to a former senior member of the Charlesbank team who knew the Sound United business, but had left the firm a few years prior. I believe I started with “well, the theory of the case is” and then launched into the rationale I noted above. He listened, let me finish, and then chuckled and said something to the effect of “If you have to say ‘theory of the case’ then I don’t think this is going to work out so well for them.” Turns out he was right. This could’ve gone better, but the odds were probably long relative to a typical acquisition.

Samsung is almost certainly getting a good deal here. They’re paying $350 million, and in 2024, the business did $700m revenue in 2024 and $235m in gross profit. While the gross profit dollars in the Masimo non-healthcare division (basically Sound United and the consumer health products Masimo was able to commercialize) are down 6-7% from where they were a couple years ago, that alone doesn’t justify a $675 million discount to the sale price a few years ago. And while tariffs won’t be great for the business, a lot of the manufacturing of these kind of devices already moved out of China years ago, and most of the underlying chips come out of Japan, as I remember all too well from late 2020. I think this comes down to Samsung being opportunistic and Masimo being pressured. Samsung is a very logical owner for the business – Sound United competes directly with many of the brands in their Harman portfolio, both in the speaker business (where I’d wager that at the high-end, Samsung can learn a thing or two from Sound United) and in the automotive licensing business (where the Samsung brands are king, but Sound United has been an emerging competitor).

On a personal level, this also illustrates the importance of having a bit of perspective at work. After a particularly good day (i.e. selling a consumer discretionary business to a medtech company in 2022, after being afraid it would fall apart entering COVID and instead seeing sales go up) it was easy to feel pretty smart. And if I was sitting on the other side of transaction, I might be feeling mighty silly, given the decline in equity value, even with the seemingly flat performance of the business. And while there’s a kernel of truth probably in both, the more prescient takeaway is that you’re probably never quite as good or bad as you think on any given day at work.

Anyway – working with the Sound United team was one of the highlights of working at Charlesbank, and I hope the lower purchase price isn’t viewed as any admission of defeat by the team that is (and was) part of the story.

Finally, this article was written with the aid of a Sound United product that theoretically could be a home health hub, but I mostly use it for music. And yes, the title is because I (unexpectedly) get to see Ben Gibbard at Red Rocks this week!