Another news day in restaurant / franchise land with an ETA angle – you know I’m there.

Restaurant Brands International (“RBI”), franchisor of Burger King, Popeye’s, and Firehouse Subs, announced today that it was acquiring Carrol’s, its largest franchisee with over 1,000 BK lounges Burger King locations and a handful of Popeye’s, for a cool $1 billion. While I’m not one to diminish how cool $1 billion is, there aren’t too many $1.8 billion revenue businesses that trade for less than $1 million per restaurant or a paltry 7x EBITDA multiple. This speaks to where the Burger King brand is versus higher-flyers in franchising (Taco Bell, Planet Fitness) as well as the overall difficulty of running restaurants these days. RBI has traded for high teens EBITDA multiples as a capital-light franchisor, so it will be interesting to see to what extent the market re-rates RBI as a more capital-intensive, less attractive public company at a lower multiple now that it owns a significant number of restaurants (I bet not but there will be confounding factors).

Burger King hasn’t really been winning the burger wars of late. Some point the finger at another example of 3G Capital management gone awry (looking at you, Kraft Heinz) – inexperienced senior management from outside the industry cutting costs at the expense of quality and innovation in highly competitive, fickle consumer markets. That narrative might be unfair to my MBA classmates and brethren, and RBI instead has pointed out that some of its franchisees have gotten distant from local market operations as they’ve scaled – and after all, Chick Fil A is probably the most successful QSR out there, and in their franchise model, local operators typically oversee one location.

I clearly wrote this just to prove I met the King – picture from RBI HQ when I was interviewing for a summer MBA internship.

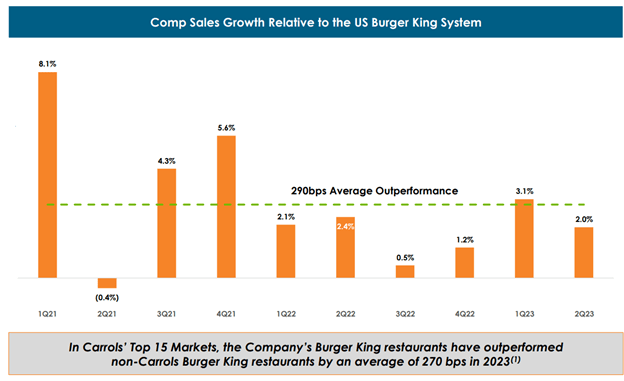

Skepticism of the RBI narrative around the impact of large franchisees on their performance is valid – after all, Carrol’s has consistently out-grown other Burger King’s in their local market. This seems to suggest that Carrol’s got an extra $50m+ of annual revenue out of these locations versus what another operator might have achieved, and for RBI corporate, that’s worth at least a few million dollars of incremental royalties, and therefore EBITDA. Helpful, but maybe less valuable than having a convenient scapegoat for the overall health of the brand, or not worth the risk of having a large franchisee with public financials, significant negotiating leverage and potential impact on the health of the overall franchise system.

Source: Carrol’s Investor Relations

RBI’s plan is to invest another $500 million to renovate the acquired locations (paid for by that sweet store-level cash flow) and then re-franchise the locations to smaller operators. In addition to reducing any concentration risk if Carrol’s, which hit nearly 9x total debt/EBITDA last year, went into financial distress (Yum Brands had a rough time when the largest Pizza Hut franchisee went belly-up a few years back, as an example), this will put shiny new locations in the hands of focused operators. If that doesn’t help propel RBI back into a stronger position in the burger wars, they’re going to have to really look inward / have some explaining to do.

This transaction also marks the final act for the former Cambridge Franchise Holdings, a roll-up of Burger King’s by two young HBS graduates, who eventually pivoted to running a PE fund focused on multi-unit businesses, Garnett Station Partners. Founders Alex Sloane and Matt Perelman started with a couple dozen distressed locations in the southeast and five years later, sold 220 locations to Carrol’s in a stock deal at $9.35/share, where they stayed on the Board as meaningful shareholders. Nearly five years later, RBI bought Carrol’s for $9.55/share, and the lack of stock price appreciation speaks to the difficulty of operating a low-margin, labor-intensive business in a brand that has seen better days. That said – it’s hard to argue that Burger King was a bad place for Sloane and Perelman to start – it’s launched them into possibly one of the most impressive young consumer investing funds out there, with a significant exit now fully crystallized (even if the IRR might’ve been better in an all-cash sale at a lower price a few years ago).

My key takeaway from this – for Alex and Matt, starting somewhere was clearly better than not starting at all, and it’s been really cool as a fellow HBS alum and multi-site consumer nerd to follow them as they grow and iterate. For franchise aficionados, this is a huge bummer, as we’re left with one fewer pure-play franchisee in the public markets to track. For Burger King, this is a huge shake-up in their franchising strategy, albeit one they’ve telegraphed. And for aspiring franchise entrepreneurs, it’s an illustration of where franchisor/franchisee relationships can end up – with an offer you can’t really refuse.